September 2024

The next EU Innovation Fund call promises to be the biggest yet with up to €7billion available in grants.

Developing a European based decarbonisation project? Get in touch...... No other consultancy has as much expertise and experience with EUIF application strategy.

December 2023

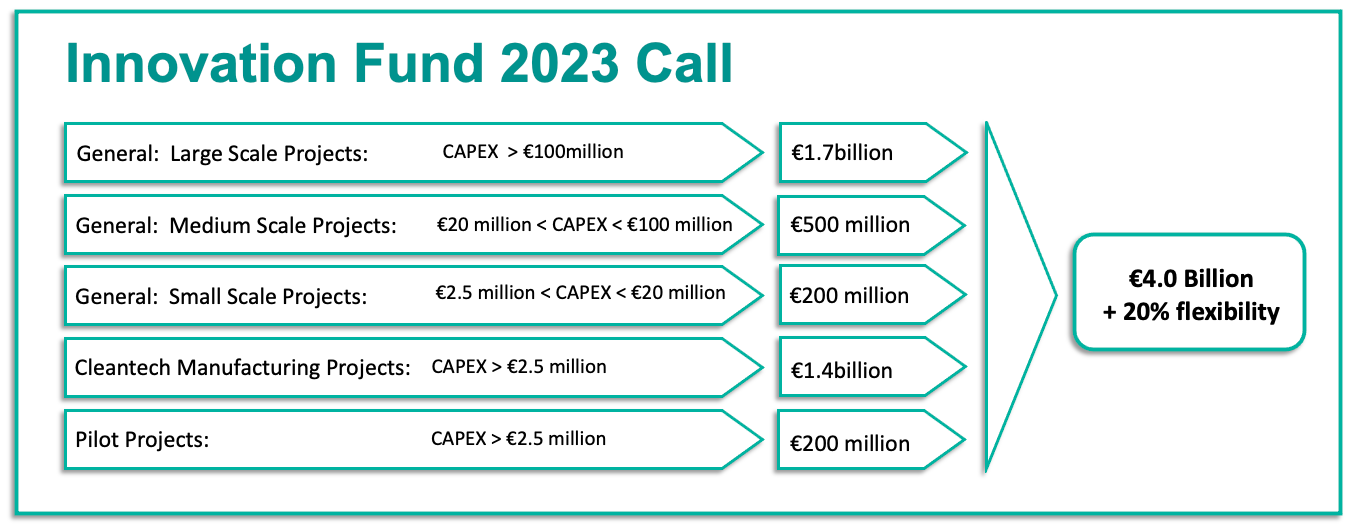

EU Innovation Fund 2023 Call

Closing date 9th April 2024

Details of the current EU Innovation Fund Call have just been announced and it’s the largest ever with up to €4.8billion of grants available for innovative European based decarbonisation projects. There’s a major shake-up of the definitions under which projects fall, a reduction in the funding available for pilot projects but a whopping €1.4billlion earmarked for cleantech manufacturing.

If you have a great project that could benefit from a share of this cash then do let us know. Verntex would be delighted to assist you in preparing your application to ensure it stands the best possible chance of success.

October 2023

Pyrolysis oil pricing

It's interesting to see that one of the major petrochemicals pricing agencies has recently launched an index to track the price of pyrolysis oil produced from waste plastics. This is a clear statement that they see this is a sector that’s destined for major growth before the end of the decade.

The vast majority of the waste plastics pyrolysis projects currently in operation however have long term offtake contracts in place and project funders are demanding that those projects which are still at the feasibility stage also strike long-term offtake deals to provide some degree of pricing certainty. There’s little doubt that steam cracker operators will also prefer to deal with pyrolysis oil producers on the basis of long-term contracts. Steam crackers are valuable assets and sensitive to a multitude of contaminants so building long term relationships with trusted suppliers will be key to ensuring they can operate using pyrolysis oil as a feedstock without mishap.

There may be one or two producers in Western Europe who are currently selling on the spot market through intermediaries but volumes are low and prices are unlikely to reflect what might be achievable when selling to an end user. Given these market dynamics and the low volumes involved, it’s challenging to see how a pricing index will currently provide a realistic benchmark of pyrolysis oil value.

Relying on such an index for calculating project economics may not, therefore, be entirely wise.

September 2023

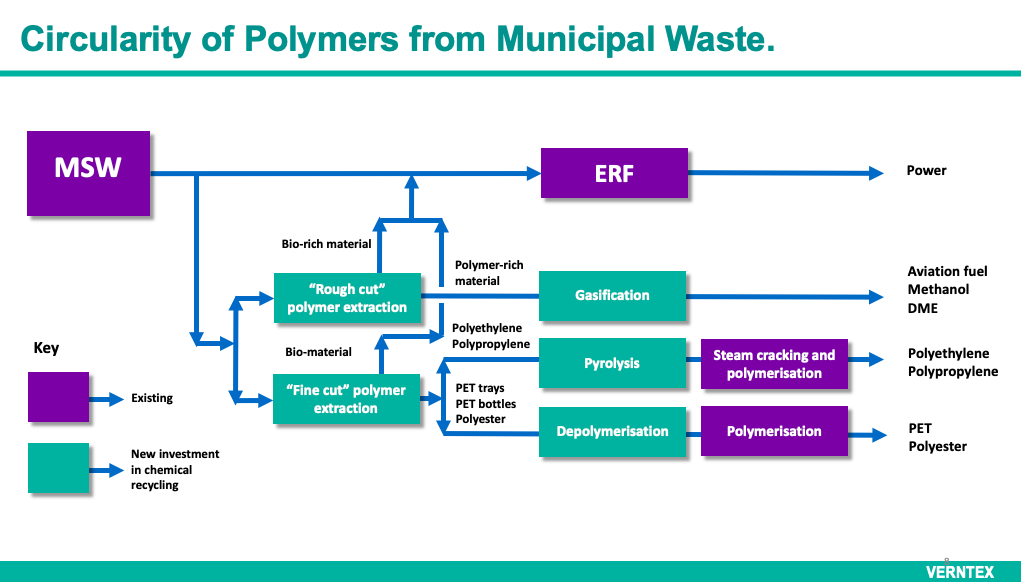

Charging Energy Recovery Facilities for emitting CO2 is set to boost recycling of municipal waste.

Between 2028 and 2030, UK and EU based energy-from-waste facilities are set to join their respective emissions trading schemes after which operators of Energy Recovery Facilities (ERFs) will be charged for every tonne of fossil-based CO2 that they emit.

While almost all these costs will be passed on to the local authourities who pay to have their waste incinerated under existing deals, those operators who manage to reduce their fossil CO2 emissions the most will be at a huge advantage compared to their peers when it comes to pitching for new contracts.

Many ERF operators are relying on carbon capture to reduce their emissions and while this is a well understood technology, it’s likely to be expensive and will require every single one of the five years up until 2028 to build and commission. The parasitic energy consumption of a bolt on carbon capture facility will also increase operating costs meaning that the levelised cost of each tonne of CO2 captured is likely to be over €250 for many operators.

Carbon capture isn’t however the only solution to ERF decarbonisation. Typically 50% of the CO2 emitted from an ERF is fossil based and most of this is caused by burning plastics. Wouldn’t it therefore be simpler to reduce fossil CO2 emissions by removing as many of the plastics as possible from municipal waste before it’s burned? Removing plastics would have the additional benefit of reducing the calorific value of waste being incinerated meaning that an ERF operator could increase the amount of waste it’s able to process. More waste = higher revenue.

Depending on the level of cleanliness and purity achieved, separated plastics can be used as an infeed into several types of chemical recycling process including those based on pyrolysis and gasification technologies. These in turn can be integrated into existing downstream petrochemical processes and the result is a collection of high value circular chemicals which demand is currently far outstripping supply.

Chemical recycling technologies aren’t perfect. Many are still at the pilot plant stage while others have variable tolerance to in-feed impurities. It’s inevitable however that with the combination of increasing CO2 emissions costs and an increasing demand for circular chemicals, chemical recycling of waste plastics is set to make a major contribution to the circular economy.

August 2023

Chemical recycling of polymers separated from municipal solid waste

Chemical recycling is currently in its infancy with some processes on the cusp of commercial roll out. Pyrolysis of separated polyolefin based plastics is currently the most widely used chemical recycling route but it does suffer from significant drawbacks.

Contaminants such as nylons or PET within the infeed to a pyrolysis process not only lead to equipment fouling, but can also have a detrimental effect on the quality of produced pyrolysis oil meaning that it must be further refined before it can be fed into a steam cracker. Producing a relatively pure separated polyolefin fraction at high volume however is neither easy or cheap.

A waste gasifier can accept an infeed with a much looser purity specification meaning that it can be a more attractive route into chemical recycling for many waste management companies. Furthermore, if methanol is the end product from the gasification process, then the presence of biogenic content in the infeed may be financially attractive because European transport emissions legislation means that methanol produced from bio-based infeed is significantly more valuable as a fuel than 'normal' methanol derived from fossil based infeed. Increasing the bio portion of infeed to a gasifier/methanol plant will therefore produce a more valuable end product.

March 2021

CO2 Emissions: £325 per tonne?

The UK Government’s announcement earlier this week of its intention to provide a total of £171 million to nine UK based hydrogen and carbon capture projects has rightly grabbed the attention of the clean energy sector. This is great news for CO2 emissions reduction and will make the UK a leader in industrial decarbonisation.

On the same day, to much less fanfare but perhaps equally significantly, the Government also launched Phase 2 of its Public Sector Decarbonisation Scheme (PSDS) through which it is seeking to provide a further £75million to reduce the carbon footprint of public sector buildings.

The PSDS announcement is significant because of a single line within its guidance notes which allows applicants to place a value of up to £325 on every tonne of CO2 saved.

To put it into context, pricing CO2 emissions at £325 per tonne is the equivalent of adding 80p to the price of a litre of gasoline. It’s also a price point at which it’s almost impossible to conceive of any clean energy project that wouldn’t provide an attractive return on investment.

If £325/tonne CO2 is an indication of where the UK Government sees the future of CO2 emissions pricing, then clean energy is the new oil and the future of the internal combustion engine is truly bleak. In the UK at least.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.